COVID-19 test expenses

From 1 July 2021, if you pay for a COVID-19 test for a work-related purpose, you can claim a deduction.

This only applies if you’re an employee, sole trader or contractor.

When you can claim COVID-19 testing

From 1 July 2021, to claim a deduction for the cost you incur to pay for a COVID-19 test, you must:

- use the test for a work-related purpose, such as to determine if you can attend or remain at work

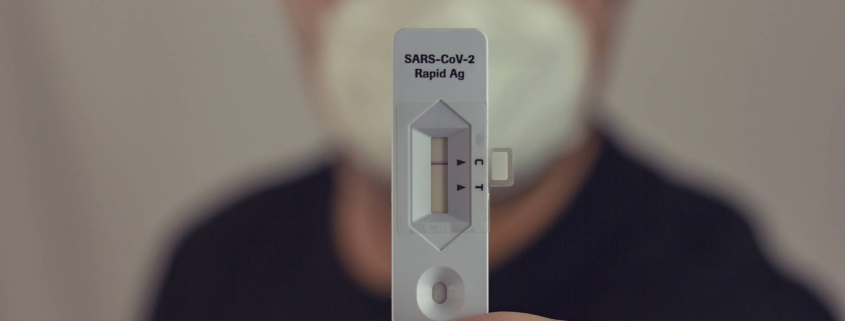

- get a qualifying COVID-19 test, such as a

- polymerase chain reaction (PCR) test through a private clinic

- other tests in the Australian Register of Therapeutic Goods, including rapid antigen test (RAT) kits

- pay for the test yourself (that is, your employer doesn’t give you a test or reimburse you for the cost)

- keep a record to prove that you incurred the cost (usually a receipt) and were required to take the test for work purposes.

You can only claim the work-related portion of your expense on COVID-19 tests. For example, if you buy a multipack of COVID-19 tests and use some for private purposes (such as by other family members or for leisure activities), you must only claim for the portion of the expense you use for a work-related purpose.

When you can’t claim COVID-19 testing

You can’t claim the cost of a COVID-19 test where any of the following apply:

- you use the test for private purposes – for example, to test your children before they return to school or daycare

- you receive a reimbursement for the expense from your employer or another person

- you work from home and don’t intend to attend your workplace.

You also can’t claim a deduction for the travel or parking expenses you incur to get your COVID-19 test because these expenses don’t have a sufficient connection to you using a COVID-19 test.

Keeping records for COVID-19 tests

You need to keep records of COVID-19 tests to demonstrate that you paid for the test and the test was required for work-related purposes. This may include a receipt or invoice, and correspondence from your employer stipulating the requirement to test.

If you don’t have a record of your expenses before the law changed on 31 March 2022, we will accept reasonable evidence of your expenses. Reasonable evidence is documents that show the cost of the test and requirement to take it for work purposes. This may include:

- bank and credit card statements

- a diary or other documents, including receipts, that show a pattern of buying COVID-19 tests after the law change that could reasonably have applied from 1 July 2021.